Get Usda Loan Sop Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Usda Loan Sop Form online

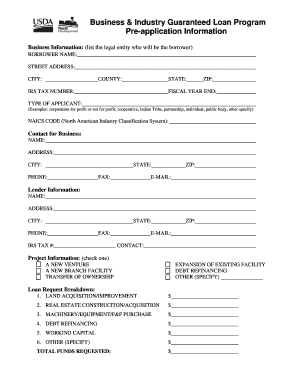

The Usda Loan Sop Form is a key document for people seeking financial assistance through the Business & Industry Guaranteed Loan Program. Filling out this form correctly is essential for a successful application, and this guide will help you navigate the process.

Follow the steps to complete the form accurately.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In the 'Business Information' section, provide details about the legal entity applying for the loan. Fill in the borrower name, street address, city, county, state, IRS tax number, zip, fiscal year end, and type of applicant. Ensure you specify whether you are a corporation, partnership, or other entity as listed.

- Complete the 'Contact for Business' section. This includes entering the name, address, city, state, phone, fax, zip, and email for the primary contact associated with the business.

- Fill out the 'Lender Information' section with similar details as the previous step, including lender name, address, and contact information to establish communication channels.

- In the 'Project Information' section, select the appropriate checkboxes to indicate whether the project is a new venture, new branch facility, or transfer of ownership.

- Detail the 'Loan Request Breakdown.' Specify the amounts requested for land acquisition, real estate construction, machinery or equipment purchases, debt refinancing, working capital, and any other specified needs.

- Provide information about current employment and anticipated job creation or savings. Fill in the current number of full-time and part-time employees, jobs created/saved, and average hourly wages.

- Answer questions regarding regulatory or legal litigation that may involve the business. Mark 'Yes' or 'No' and provide details if applicable.

- Attach necessary supporting documentation as listed, which may include financial statements, business plans, and letters from lenders. Ensure all documents are current and complete.

- Once all sections are thoroughly completed, save your changes, download the filled form, and print or share it as required for submission.

Start filling out the Usda Loan Sop Form online today to take the first step towards securing your loan.

Yes, USDA requires two months of bank statements to verify your financial status and income. Providing these statements helps show that you have a reliable source of income and can manage your finances. Gathering this information in advance can simplify the loan application process. Using the Usda Loan Sop Form can streamline how you organize and present these documents, ultimately aiding your application.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.