Loading

Get St 1191 Fillable Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the St 1191 Fillable Form online

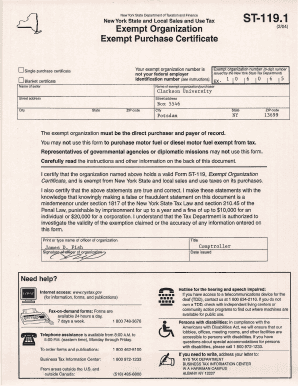

Filling out the St 1191 Fillable Form online can streamline your process for obtaining sales and use tax exemptions in New York. This guide provides clear instructions to help you navigate and complete each section of the form effectively.

Follow the steps to successfully fill out your St 1191 Fillable Form online.

- Press the ‘Get Form’ button to obtain the form, ensuring it opens in your preferred editor.

- Indicate whether you are using a single purchase certificate or a blanket certificate by selecting the appropriate option at the top of the form.

- Enter your exempt organization number, which is a 6-digit number issued by the New York State Tax Department, in the designated space. Ensure this is not your federal employer identification number.

- Fill in the name of the seller in the relevant field, ensuring it's legible and accurate.

- Provide the name of your exempt organization or purchaser in the corresponding field. For example, you may enter 'Clarkson University.'

- Complete the street address, including any necessary box numbers, along with the city, state, and ZIP code of your organization.

- Read and understand the statement regarding the misuse of the form, ensuring you comply with the rules concerning purchases of motor fuel or diesel motor fuel.

- Certify the information by printing or typing the name of the officer of the organization responsible for the purchase, along with their title and the date on which the form was issued.

- Review all entered information for accuracy before finalizing your document.

- Once your form is complete, you can save the changes, download a copy, print it, or share it as needed.

Start filling out your St 1191 Fillable Form online today for a smoother tax exemption process.

You can obtain a Colorado sales tax exemption certificate by applying through the Colorado Department of Revenue. Alternatively, the St 1191 Fillable Form on uslegalforms can help streamline this process. Having the right form increases your chances of a quick approval.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.