Loading

Get St 220 Td

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the St 220 Td online

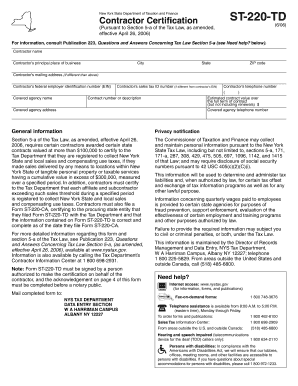

The St 220 Td form is a crucial document for contractors in New York State to certify their registration status for tax purposes. This guide will provide you with clear, step-by-step instructions on how to complete the form online, ensuring that you understand each component of the document.

Follow the steps to fill out the St 220 Td form online.

- Click ‘Get Form’ button to access the St 220 Td document and open it for editing.

- Enter the contractor’s name in the designated field. Make sure the name matches the legal entity's registration.

- Fill in the contractor’s principal place of business, including city, state, and ZIP code.

- If the mailing address is different, provide that information in the mailing address section.

- Input the contractor’s federal employer identification number (EIN) and the sales tax ID number if it differs from the EIN.

- Provide the contractor’s telephone number, ensuring it is valid and active.

- Fill in the covered agency name, along with the corresponding contract number or description.

- Indicate the estimated contract value over the full term of the contract, excluding renewals.

- Proceed to the contractor registration status section. Select the relevant option that applies to your sales activities.

- Complete the affiliate registration status section, choosing the appropriate declaration regarding affiliates.

- Fill out the subcontractor registration status section, following a similar process as the previous steps.

- Sign the form where indicated, ensuring that an authorized person makes the certification.

- Complete the acknowledgment section in the presence of a notary public to ensure the document is validated.

- Finally, save your changes, and you may choose to download, print, or share the completed form as necessary.

Complete your St 220 Td form online today to ensure compliance with New York State tax regulations.

Independent contractors must fill out specific tax forms to report their income accurately. Generally, they will use Form 1099-NEC to report payments received and may also need to utilize the St 220 Td for sales tax purposes, depending on their services. It’s important to keep track of all income and expenses to facilitate this process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.