Loading

Get Missouri Tf Instructions

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Missouri Tf Instructions online

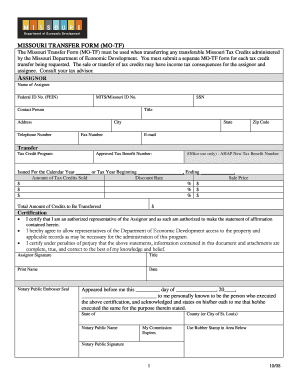

The Missouri Transfer Form (MO-TF) is essential for transferring Missouri Tax Credits. This guide provides clear steps to help you navigate and complete the form efficiently, ensuring that every field is accurately filled out for successful processing.

Follow the steps to complete the Missouri Tf Instructions online.

- Press the ‘Get Form’ button to access the Missouri Transfer Form. This will allow you to open the document in an online editor ready for input.

- Begin by filling out the 'Assignor' section with all required information, including the name, federal ID number, Missouri ID number, contact details, and the type of tax credit program.

- Provide the approved tax benefit number along with the calendar year or tax year for which the credits were issued. Be sure to indicate the amount of tax credits being sold and the applicable discount rate.

- Calculate and enter the total amount of credits to be transferred, which combines the elements listed above.

- Complete the 'Certification' section where the assignor asserts their authority and accuracy of the provided information. Ensure to provide the signature, title, printed name, and the date.

- If required, have a notary public witness this section. They will need to fill out their details and affix their seal, confirming the execution of the document.

- Move to the 'Assignee' section and fill in the necessary details for the assignee, including their name, federal ID number, contact details, and type (e.g., C Corp, LLC, etc.).

- If applicable, list the partners or owners in the appropriate fields, indicating their names, Social Security numbers, and ownership percentages.

- Complete the Assignee's certification where they also affirm the accuracy of information. Provide their signature, title, printed name, and date.

- After filling out all sections, review the entire form for accuracy before saving changes. You may then download, print, or share the completed form as needed.

Complete your Missouri Tf Instructions online today to ensure a seamless transfer of tax credits.

The $12,000 property tax exemption in Missouri provides significant tax relief to qualifying homeowners by exempting the first $12,000 of assessed value from property taxes. This benefit is primarily designed for seniors, veterans, and individuals with disabilities. To apply and understand the requirements, check the Missouri Tf Instructions for detailed guidance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.