Get Ptr 2a Of 2014 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ptr 2a Of 2014 Form online

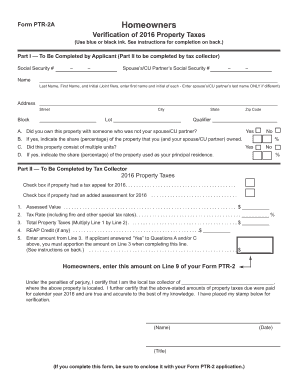

Filling out the Ptr 2a Of 2014 Form is an essential step for homeowners seeking property tax reparation. This guide will walk you through the process in a clear and supportive manner, ensuring that you have the necessary information to complete each section accurately.

Follow the steps to fill out the Ptr 2a Of 2014 Form online.

- Use the ‘Get Form’ button to obtain the form and access it in an editable format.

- In Part I, enter your Social Security number in the designated space. If you are married or in a civil union, include your partner’s Social Security number as well.

- Provide your last name, first name, and middle initial. If filing jointly, include your spouse's or civil union partner's last name only if it differs from your own.

- Fill in your property address, including street, block, city, state, and zip code.

- Enter the block and lot numbers for the property you are claiming. Include a qualifier if applicable (e.g., for condominiums).

- Answer the question about joint ownership. If you owned the property with someone who is not your partner, mark 'Yes'; otherwise, mark 'No.'

- If applicable, indicate the percentage of property ownership you and your partner hold.

- Answer whether the property has multiple units. If yes, indicate the percentage of your principal residence.

- Part II will be completed by the tax collector. Ensure all sections are filled completely by the designated authority before submission.

- Finally, review all the information entered for accuracy. Save changes, and if required, download, print or share the completed form.

Start completing your Ptr 2a Of 2014 Form online today to ensure your property tax reimbursement!

The primary difference between PTR 1 and PTR 2 in New Jersey lies in the eligibility requirements and benefits they provide. PTR 1 is for the Homestead benefit program aimed at all homeowners, while PTR 2 addresses property tax reimbursements for senior citizens and disabled residents. By understanding these distinctions, you can more easily determine which form, including the PTR 2a of 2014 form, is right for your situation.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.