Loading

Get Dentist W9

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Dentist W9 online

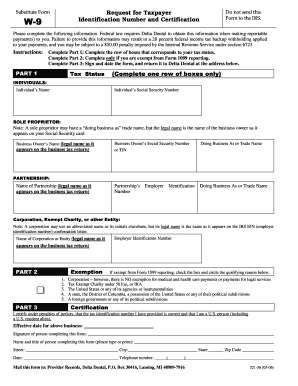

The Dentist W9 form is a crucial document for tax identification and certification purposes. This guide will help you understand each section of the form and provide step-by-step instructions for completing it online.

Follow the steps to complete the Dentist W9 with ease.

- Click ‘Get Form’ button to obtain the form and open it in your online document editor.

- In Part 1, identify your tax status. You will need to complete the row of boxes corresponding to your status, selecting only one. Provide your name and Social Security Number or Tax Identification Number.

- If you are a sole proprietor, write your legal name as it appears on your Social Security card and include your business name (doing business as) if applicable. If you identify as a partnership or corporation, fill in the respective sections with the legal name and Employer Identification Number.

- Proceed to Part 2 only if you are exempt from Form 1099 reporting. Check the appropriate box and circle the reason for your exemption from the provided options.

- In Part 3, sign and date the form to certify that your tax identification number is correct and that you are a U.S. person (including a U.S. resident alien). Please also provide your name, title, and telephone number.

- Once completed, ensure all information is accurate, then save any changes. You will have options to download, print, or share your completed Dentist W9 form as needed.

Complete your Dentist W9 online today for a smooth filing experience.

You can obtain a W-9 form from various sources. The requesting party may provide it, or you can download a template from the IRS website or legal form platforms such as UsLegalForms. For a Dentist W9, make sure to have your tax identification number and other necessary information handy to complete the form accurately.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.