Get Mcc - 003 Application And Affidavit - Nhf - Nhfloan

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MCC - 003 Application And Affidavit - NHF - Nhfloan online

Completing the MCC - 003 Application and Affidavit is an important step in applying for a mortgage credit certificate. This guide provides clear, step-by-step instructions to help you fill out the form online with ease and confidence.

Follow the steps to successfully complete your application.

- Click the ‘Get Form’ button to obtain the form and open it in your online editor.

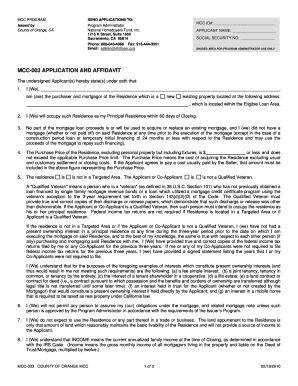

- Fill in the MCC ID number in the designated field at the top of the form.

- Provide your full name in the 'Applicant Name' field and enter your Social Security number.

- Enter your phone number and optional email for further communication.

- Indicate whether you are applying as a 'Qualified Veteran' and fill out the relevant sections detailing your military status if applicable.

- Complete the section regarding the property, including the address, type of residence (new or existing), and confirm your intent to occupy it as your principal residence.

- Input the Purchase Price of the Residence, ensuring it meets the applicable limits set by the program.

- Provide accurate income information by calculating your total monthly income, including all sources of income as outlined in the form.

- List the number of individuals who will reside in the household, ensuring to note any co-applicants.

- Carefully read and acknowledge the information relating to potential tax recapture, signing off on your understanding in the appropriate section.

- Review and confirm that all the information provided in the application is accurate. Once completed, look for options to save changes, download, print, or share the form.

Complete your MCC - 003 Application and Affidavit online today to take the next step towards your home financing.

Yes, the MCC - 003 Application And Affidavit - NHF - Nhfloan can be used independently of the Down Payment Assistance (DPA). This option allows you to benefit from the tax advantages offered by an MCC while exploring other financing solutions. However, many borrowers find that combining the MCC with DPA options can maximize their benefits, enabling them to achieve their homeownership goals more effectively.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.