Loading

Get Boe 401 Ds

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Boe 401 Ds online

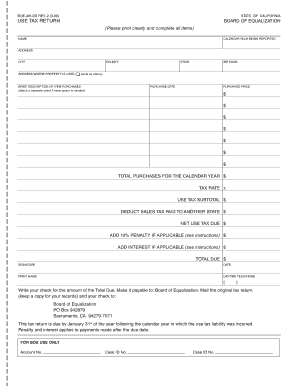

Filling out the Boe 401 Ds online can streamline your use tax reporting process. This guide will provide you with clear, step-by-step instructions to ensure you complete the form accurately and efficiently.

Follow the steps to successfully complete your Boe 401 Ds form online

- Click ‘Get Form’ button to obtain the document and open it in your chosen online editor.

- Fill in your name, address, city, county, state, and zip code in the designated fields.

- Enter the calendar year for which you are reporting your purchases.

- Provide a brief description of each item purchased, along with the purchase date and its dollar amount. Attach a separate sheet if more space is needed.

- Calculate and enter the total amount of your purchases for the year.

- Multiply the total purchases by the applicable sales and use tax rate to determine the use tax subtotal.

- Deduct any sales tax paid to another state for these purchases, ensuring you keep any receipts for your records.

- If applicable, add a 10% penalty for late payment and any interest due, which is calculated for each month or part of a month after the due date.

- Sum the net use tax due with any penalties or interest to find the total amount owed.

- Sign and date your form, and include a daytime telephone number where you can be reached.

- Make your check payable to the Board of Equalization for the total due amount, attach it to your completed form, and ensure to mail both to the specified address, keeping a copy for your records.

Complete your Boe 401 Ds form online today for a smoother tax filing experience.

Yes, the sale of inventory can be reported on Form 4797, especially if the inventory is classified as business property. This form is key for reporting gains or losses from the sale of property, making it essential for those dealing with Boe 401 Ds. Understanding when to use Form 4797 can prevent errors and ensure accurate reporting on your tax return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.