Get Department Of Commerce Division Of Financial Institutions - Mn

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the DEPARTMENT OF COMMERCE DIVISION OF FINANCIAL INSTITUTIONS - Mn online

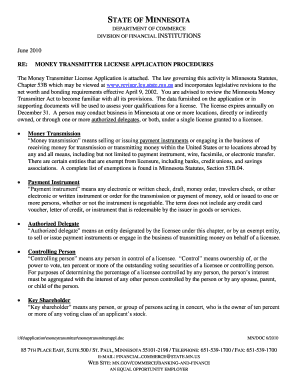

Filling out the DEPARTMENT OF COMMERCE DIVISION OF FINANCIAL INSTITUTIONS - Mn application is a crucial step for individuals or businesses seeking a money transmitter license in Minnesota. This guide provides clear and supportive instructions to help you navigate through the online application process.

Follow the steps to complete your application successfully.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by filling out the applicant information section. This includes your business name or individual name, the name under which the money transmitter business will operate in Minnesota, and the complete principal street address. It is important to provide accurate contact information, including phone and fax numbers, and an email address.

- Proceed to indicate the type of entity, choosing between options like corporation, limited liability company, or sole proprietor. Depending on your entity type, you may skip certain sections that are not relevant.

- Complete the license qualifications section. Provide details about your net worth, ensuring it meets the requirements based on the number of locations involved in money transmission. This step requires careful attention to ensure compliance with statutory mandates.

- Fill out the general requirements. You must disclose any litigation history or criminal convictions that could impact your application. Be thorough and provide supporting documents if necessary.

- Include the descriptions of your proposed business activities, including identifying authorized delegates, if applicable. Make sure to attach any necessary samples as requested.

- Once all fields are filled, check that you have included any required enclosures and that your application fee is prepared. The total non-refundable application fee is $4,150.

- Review your application for accuracy, ensuring all sections are completed and signatures are provided where needed. Save your changes and choose to download, print, or share the form as required.

Complete your application online for the money transmitter license today!

The Department of Financial Services (DFS) covers a broad spectrum of responsibilities, including oversight of banks, insurance providers, and securities businesses. Each area requires specific regulations and compliance measures to protect consumers. Although different from the DEPARTMENT OF COMMERCE DIVISION OF FINANCIAL INSTITUTIONS - Mn, both entities share the goal of ensuring a secure financial framework.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.