Get Form 71 661

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 71 661 online

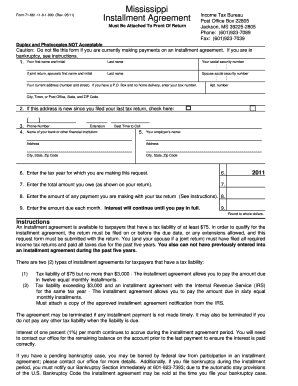

Filling out Form 71 661 online can streamline the process of requesting an installment agreement for your tax liabilities. This guide provides clear and supportive instructions to help you navigate each section of the form with ease.

Follow the steps to fill out Form 71 661 correctly.

- Click ‘Get Form’ button to access the document and open it for editing.

- Begin by entering your last name and social security number in the designated fields. This information identifies you as the individual submitting the form.

- In the next fields, enter your first name and initial. If applicable, provide your spouse's first name and initial as well.

- Complete your current address, including the street number, apartment number (if any), city, state, and ZIP code. If you only have a P.O. Box, use that instead.

- If you are using a new address compared to your last tax return, check the box to indicate the change.

- Provide your phone number and extension so that the tax bureau can reach you if necessary.

- Enter the name of your bank or financial institution, as well as the best time to call you.

- Fill in your employer's name followed by the address, including city, state, and ZIP code to give context about your employment.

- Indicate the tax year for which you are requesting the installment agreement.

- Input the total amount you owe as indicated on your return. This amount must be confirmed to ensure accuracy.

- If you are making a payment with this request, enter this amount in the specified field.

- Specify the amount you plan to pay each month under the installment agreement, rounding to the nearest whole dollar as required.

- Once all sections are filled out completely, review the form for accuracy. After ensuring all information is correct, you can save your changes, download the form, print it for your records, or share it as needed.

Ensure your tax dealings are managed efficiently by completing Form 71 661 online today.

Get form

Form 11 should be filled out according to the instructions provided by the relevant tax authority. Typically, you can complete Form 11 online or by hand, depending on the administrative requirements in your state. If you're looking to understand this process better, consider using USLegalForms, which can offer templates and verification tools while you work through Form 71 661. This can help ensure your compliance with local regulations.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.