Get Att-17 (rev - Etax Dor Ga

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the ATT-17 (Rev - Etax Dor Ga online

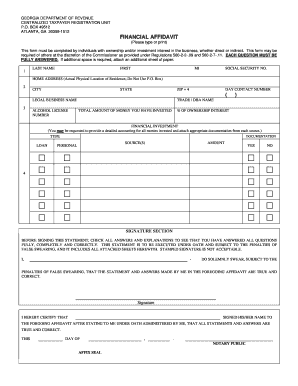

Filling out the ATT-17 (Rev - Etax Dor Ga) form is an essential step for individuals with ownership or investment interest in a business. This guide will provide you with clear instructions on how to effectively complete this form online, ensuring that all necessary information is accurately reported.

Follow the steps to successfully complete the ATT-17 (Rev - Etax Dor Ga) form.

- Press the ‘Get Form’ button to access the ATT-17 (Rev - Etax Dor Ga) form and open it in your preferred online editor.

- Begin by entering your last name, first name, and middle initial in the designated fields.

- Provide your Social Security number in the following section.

- Enter your home address, making sure to include the city, state, and ZIP plus 4 code. Avoid using a P.O. Box.

- Next, fill in your day contact number where you can be reached.

- In the legal business name field, enter the formal name under which the business operates.

- Include the alcohol license number if applicable.

- Indicate the trade or DBA (Doing Business As) name, if different from the legal business name.

- Report the total amount of money you have invested in the business.

- Specify your percentage of ownership interest in the business.

- Detail your financial investment and be prepared to provide documentation regarding the source of your investments.

- Finally, review all your answers in the signature section, ensuring that you have answered all questions completely and correctly.

- Sign the affidavit to affirm that all statements made are true and correct.

- If necessary, have your affidavit notarized by a notary public before submitting.

- After completing the form, save your changes, and consider downloading, printing, or sharing the form as needed.

Complete the ATT-17 (Rev - Etax Dor Ga) form online today to ensure your compliance and streamline your filing process.

Yes, you can file your Georgia taxes electronically, which is a convenient and secure option. E-filing minimizes errors and expedites processing times for your return. Various platforms, including those offered by uslegalforms, support electronic filing with user-friendly interfaces. This can enhance your overall tax filing experience.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.