Loading

Get Ga Form 5347

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ga Form 5347 online

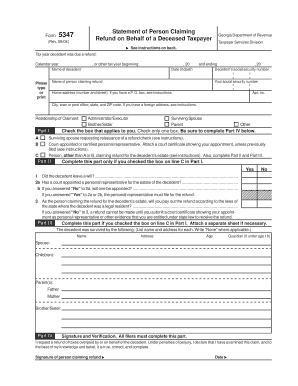

Filling out the Ga Form 5347 allows you to claim a tax refund on behalf of a deceased taxpayer. This guide provides a clear and structured approach to help you complete the form efficiently and accurately.

Follow the steps to fill out the Ga Form 5347 online

- Press the ‘Get Form’ button to obtain the form and open it for editing.

- Begin by entering the tax year for which the decedent was due a refund. Specify whether it's a calendar year or another tax year.

- Fill in the name of the decedent as it appears on their tax records.

- Provide the date of death for the decedent. Make sure this is accurate, as it may be checked against official records.

- Enter your own name as the person claiming the refund, ensuring clarity in your written response.

- Input both the decedent’s social security number and your own social security number.

- Complete the home address field. If using a P.O. box, refer to the instructions to ensure compliance.

- Select the appropriate relationship to the decedent by checking only one box from the options provided in Part I.

- If you checked box C in Part I, proceed to Part II. Answer all questions regarding whether the decedent left a will and if a personal representative has been appointed.

- In Part III, list any surviving relatives as required and provide their names and addresses, using 'None' where applicable.

- Finalize by signing and dating the form in Part IV to verify your claim and declare its truthfulness.

- Once all information is entered, save your changes, and consider downloading or printing the completed form for your records or submission.

Begin your process of filing documents online to ensure a smooth claiming experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

The IRS does not issue a refund directly to a deceased individual; instead, refunds are sent to the estate. The executor manages this process and can then distribute the refund according to the needs of the estate. It's essential to properly file the necessary forms, and Ga Form 5347 can be an invaluable resource during this process.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.