Loading

Get Kansas Form Ct 114

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Kansas Form Ct 114 online

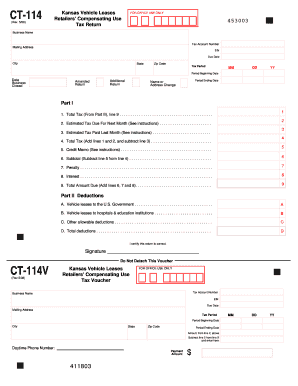

Filling out the Kansas Form Ct 114 can be done efficiently online. This guide provides you with step-by-step instructions to ensure that you complete the form accurately and meet all required deadlines.

Follow the steps to fill out the Kansas Form Ct 114 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by completing Parts II and III before moving on to Part I. Ensure you have accurate and complete information at hand to fill in the necessary details.

- In Part I, line 1, enter the gross sales of vehicle leases in Kansas taken from line 9 of Part III.

- If your filing frequency is prepaid monthly, complete lines 2 and 3. For line 2, input the estimated tax due for the following calendar month. If your total tax liability exceeds $32,000 in any calendar year, ensure payment meets the required guidelines.

- For line 3, enter the estimated tax paid from last month’s return if applicable.

- On line 4, add lines 1 and 2, and subtract line 3 to calculate the total tax due.

- In line 5, enter any credit memorandum received from the Kansas Department of Revenue if applicable.

- Continue to line 6 by subtracting line 5 from line 4 to find your subtotal.

- For lines 7 and 8, input any penalties or interest due if this is a late return, based on the latest rates from the website.

- Line 9 requires you to add lines 6, 7, and 8 to find the total amount due.

- Move to Part II, where you will list any deductions on lines A through C and calculate the total to enter on line D. Ensure all deductions are allowable.

- In Part III, enter the necessary information regarding the location breakdown. This includes jurisdiction codes and gross vehicle lease amounts throughout the taxable period.

- Complete columns 1 through 6 as directed, ensuring all values reflect accurate calculations.

- For lines 7 through 9 in Part III, ensure you sum the totals correctly and enter them for final reporting.

- After completing all sections, save your changes, download the document, and prepare to print or share as required.

Complete your Kansas Form Ct 114 online today to ensure compliance and meet your tax obligations.

Individuals and businesses that earn income in Kansas must file a Kansas tax return, even if they have no tax liability. This includes residents and non-residents who have ties to the state. If you have purchased items requiring compensating use tax, be sure to include this when filing your return using Kansas Form Ct 114. Utilizing services like US Legal Forms can assist you in completing your tax return accurately and efficiently.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.