Loading

Get Kansas K 40v Fillable Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Kansas K 40v Fillable Form online

Filling out the Kansas K 40v Fillable Form online can streamline your income tax payment process. This guide provides comprehensive steps to complete the form accurately and efficiently, ensuring you meet your tax obligations.

Follow the steps to fill out the Kansas K 40v Fillable Form online:

- Click the ‘Get Form’ button to obtain the Kansas K 40v Fillable Form and open it in your preferred online editor.

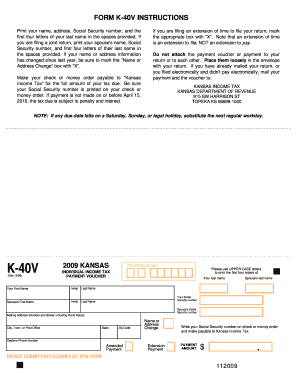

- Print your name, address, Social Security number, and the first four letters of your last name in the designated fields. If filing jointly, include your partner's information as well.

- If there has been any change in your name or address since the previous year, mark the 'Name or Address Change' box with an 'X'.

- Make your payment by check or money order payable to 'Kansas Income Tax' for the total amount due. Ensure that your Social Security number is included on your payment.

- If you are requesting an extension to file your return, select the appropriate box with an 'X'. Remember, an extension to file does not extend your time to make payment.

- Do not attach the payment voucher or payment to your return; instead, place them loosely in the envelope alongside your return.

- If you have already mailed your return, or filed electronically without electronic payment, send your payment and voucher to: Kansas Income Tax, Kansas Department of Revenue, 915 SW Harrison St, Topeka KS 66699-1000.

- Once completed, you may save your changes, download the form, print it out, or share it as needed.

Start filling out your Kansas K 40v Fillable Form online today!

To complete the K-4 form for Kansas withholding, begin by entering your personal information, such as your name and address. Next, indicate your filing status and the number of allowances you are claiming. Ensure you review the instructions for any specific adjustments related to your tax situation. Utilizing the Kansas K 40v Fillable Form can simplify this process, allowing you to enter information easily and submit it electronically.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.