Loading

Get D 2848 Instructions

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the D 2848 Instructions online

This guide provides clear and structured instructions for completing the D 2848 Instructions online. Whether you are familiar with tax documents or not, this step-by-step approach will help you navigate the form with confidence.

Follow the steps to complete your D 2848 Instructions effectively.

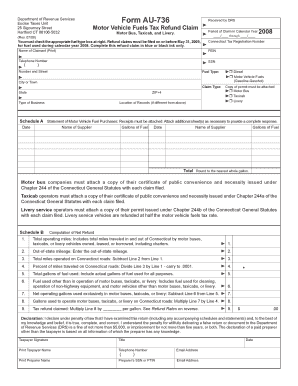

- Click the 'Get Form' button to access the D 2848 Instructions. This will open the form in an online auto-fill editor for your convenience.

- Begin by filling out your name and contact information, ensuring accuracy in your entries.

- Select the appropriate sections for your specific fuel type and claim type by marking the corresponding boxes.

- Complete the Connecticut Tax Registration Number, Federal Employer Identification Number (FEIN), or Social Security Number (SSN) in the designated fields.

- Detail all fuel purchases by providing the date, supplier name, and number of gallons. Ensure you attach all necessary receipts.

- In Schedule B, calculate the total operating miles, out-of-state mileage, and total miles operated on Connecticut roads as instructed.

- Fill in the computations for net refund, ensuring that you accurately multiply the gallons by the specified rate.

- Review the declaration statement and make sure to sign it, confirming that all information is accurate and truthful.

- After completing the form, save your changes, and download a copy for your records. You may also print or share the completed form as needed.

Complete your D 2848 Instructions online today for a smooth filing experience.

You can specify multiple tax years on IRS Form 2848, as long as you clearly indicate each year or period. This will allow your representative to handle matters for those specified years. However, do not forget that clarity is crucial; ensure you follow the D 2848 Instructions accurately. This will help avoid any confusion when submitting.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.