Loading

Get Form Ptax 323

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form Ptax 323 online

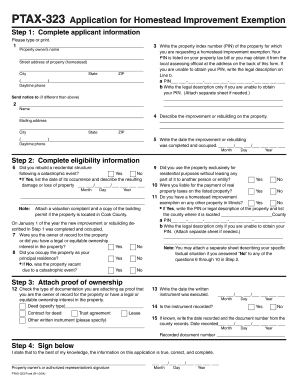

This guide provides clear, step-by-step instructions for filling out the Form Ptax 323 online. This application is essential for individuals seeking a homestead improvement exemption on their property.

Follow the steps to complete your Form Ptax 323

- Use the 'Get Form' button to access the document and open it in the editing interface.

- Begin by entering the applicant information: Write the property owner’s name, the street address of the property, city, state, and ZIP code. Include a daytime phone number.

- Document the property index number (PIN) for the property requesting the exemption. If the PIN is unavailable, provide the property's legal description.

- Describe the improvement or rebuilding done on the property. Be thorough in your description.

- Indicate the date the improvement or rebuilding was completed and occupied by filling in the month, day, and year.

- Complete the eligibility section by answering questions regarding ownership, occupation, exclusive use, liability for taxes, and existence of exemptions on other properties.

- Attach proof of ownership documentation. Specify the type of documentation and record the date executed.

- Indicate whether the instrument is recorded. If so, provide the recording date and document number.

- Sign the application to verify that the information provided is accurate before submitting.

- Once all fields are filled out, save your changes, download or print the completed form for your records, or share it with the appropriate local assessing official.

Complete your documents online and ensure you secure your homestead improvement exemption today.

Yes, you can file your Texas homestead exemption online through the Texas Comptroller's website or your local appraisal district’s site. Make sure to complete Form Ptax 323 electronically if it's available in your area. Filing online often speeds up the process and provides you with immediate confirmation. Should you have any questions, the uslegalforms platform offers various resources to assist you.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.