Get 309 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 309 Form online

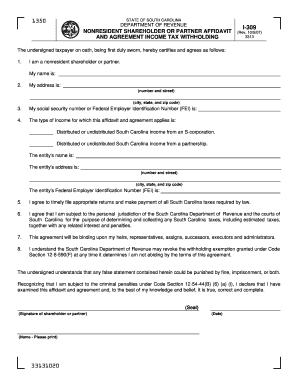

The 309 Form, also known as the Nonresident Shareholder or Partner Affidavit and Agreement for Income Tax Withholding, is essential for nonresident individuals to request an exemption from withholding taxes in South Carolina. This guide provides clear, step-by-step instructions for completing the form online, ensuring a smooth process.

Follow the steps to fill out the 309 Form online

- Press the ‘Get Form’ button to access the 309 Form and open it in your preferred digital format.

- Begin filling out the form by entering your name in the designated field for the taxpayer. Ensure that the name matches the legal identification.

- In the address section, provide your complete address, including number and street, city, state, and zip code.

- Enter your Social Security number or Federal Employer Identification Number (FEI) in the appropriate field.

- Indicate the type of income applicable by selecting either ‘distributed’ or ‘undistributed’ South Carolina income from an S-corporation or partnership. Fill in the name and address of the respective entity, followed by its FEI.

- Review the agreement sections carefully, affirming your commitment to timely filing and payment of any required taxes in South Carolina.

- Confirm your understanding of the jurisdiction of the South Carolina Department of Revenue and the binding nature of the agreement by checking the affirmation box.

- Provide your signature, print your name, and date the form to authenticate your affidavit.

- Once you have completed all fields, save your changes. You can then download, print, or share the completed form as necessary.

Complete your documents online to simplify your filing process.

The first line of a W9 form requires you to enter your name or the name of your business. This is crucial because it identifies the taxpayer associated with the tax identification number you will provide. For clarity and accuracy, ensure the name matches the one on your tax return when completing the W9, as this directly links to the 309 Form in various reporting scenarios.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.