Get Ny Ct 60

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ny Ct 60 online

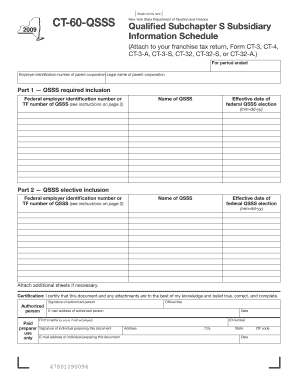

Filling out the Ny Ct 60 form online can seem daunting, but with clear steps and guidance, it becomes a manageable task. This guide is designed to assist individuals and organizations in completing the Qualified Subchapter S Subsidiary Information Schedule accurately and efficiently.

Follow the steps to complete the Ny Ct 60 online.

- Click ‘Get Form’ button to access the form and open it in your preferred editor.

- Begin with Part 1, where you will enter the required inclusion information for each Qualified Subchapter S Subsidiary (QSSS). Fill in the federal employer identification number or TF number of the QSSS and the name of the QSSS. Specify the effective date of the federal QSSS election in the designated format (mm-dd-yy).

- Proceed to Part 2, which is for elective inclusion. Here, provide the same information as in Part 1 for any QSSS you choose to include voluntarily. Ensure that you also enter the effective date of the QSSS election for these subsidiaries.

- If necessary, attach additional sheets to provide full information on all QSSS that are relevant. Make sure that any attachments are easily identifiable.

- In the certification section, an authorized person needs to provide their signature, official title, email address, and firm’s name if applicable. This section confirms that the information is accurate to the best of their knowledge.

- Fill in the preparer's details, including their signature, email address, and the date the form is prepared, ensuring accuracy in this section.

- Once all fields are completed, review the form for any errors or missing information. Then, save your changes, and choose to download, print, or share the form as needed.

Complete your documents online with confidence and clarity.

To form an S-corp in New York, you must first establish a corporation by filing the Articles of Incorporation. Your corporation must meet specific requirements, such as having no more than 100 shareholders, all of whom must be U.S. citizens or residents. Additionally, your S-corp must have only one class of stock. For detailed assistance in meeting these requirements, uslegalforms can help simplify the process and ensure compliance.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.