Loading

Get Icma Trustee To Trustee Transfer Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Icma Trustee To Trustee Transfer Form online

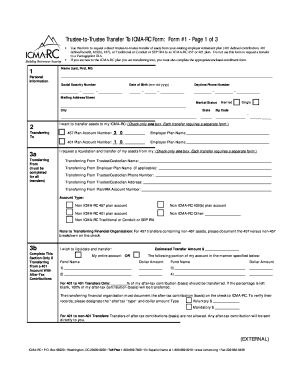

This guide provides a clear, step-by-step approach to completing the Icma Trustee To Trustee Transfer Form online. Whether you are transferring funds from another financial organization or from an existing ICMA-RC account, this comprehensive guide is designed to assist you in navigating the form with ease.

Follow the steps to complete the Icma Trustee To Trustee Transfer Form.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Before filling out the form, contact your previous financial institution to determine if they require additional documentation to facilitate the transfer to ICMA-RC. Ask them if ICMA-RC forms are sufficient for the transfer.

- Provide a copy of your driver’s license and the most recent statement from your former provider. These documents are necessary for verification purposes.

- In Section 1 of the form, complete your personal information, including your name, date of birth, Social Security number, and contact information.

- In Section 2, indicate the account number of the 457 or 401 plan where you are transferring your funds, along with your employer’s name.

- For Section 3a, specify the account from which you are transferring funds. Ensure you indicate the correct type of account.

- If applicable, complete Section 3b to designate any after-tax contributions from a 401 account and indicate the percentage of these contributions to be transferred.

- In Section 4, allocate your transferred assets among the available investment options, making sure the total allocation equals 100%.

- Obtain your employer's authorization in Section 6 by having them sign the form, confirming you are eligible to transfer to the specified ICMA-RC account.

- If necessary, complete Section 7 for signature guarantees, which may be required for some transfers.

- Sign and date Section 5 to confirm your request and acknowledge disclosures.

- Once you have completed the form, make copies for your records. Mail the original forms along with any required documents to ICMA-RC at the specified address.

Complete your documents online now to facilitate your transfer process.

Yes, a trustee-to-trustee transfer typically generates a Form 5498. This form reports contributions and transfers to your retirement account. You should keep this for your records, as it helps track your retirement savings. Using the Icma Trustee To Trustee Transfer Form ensures that the process is handled accurately.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.