Get Utma Account

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Utma Account online

This guide provides a clear and comprehensive approach to filling out the Utma Account form online. By following these instructions, users can easily navigate through the necessary steps and ensure that all required information is correctly provided.

Follow the steps to complete your Utma Account form online.

- Click the ‘Get Form’ button to access the Utma Account form and open it in your designated editor.

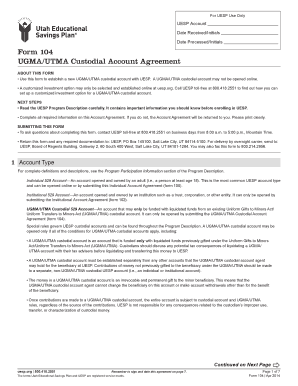

- Begin with Section 1, where you will select the account type. Ensure you choose the appropriate option for a UGMA/UTMA custodial account.

- In Section 2, provide the details of the UGMA/UTMA custodial account agent. Include their name, address, and payment information as required.

- Move to Section 3, and list the beneficiary's details. The beneficiary should be identified, along with their relationship to the custodial account agent.

- In Section 4, choose the investment option for the account. Select from age-based or static options, or customize your selection as needed.

- Complete Section 5 if you wish to make an initial contribution. Indicate the sources of funding that comply with UGMA/UTMA guidelines.

- If you plan to set up automated contributions, fill out Section 6 with the required bank information, contribution amounts, and schedules.

- In Section 8, provide your signature and date to authorize the account opening. Ensure all sections that require signatures are completed.

- After completing the form, save any changes, and download or print the filled form for your records. Remember to close your browser to protect your personal information.

Complete your Utma Account form online today to get started on your educational savings journey.

A UTMA account, or Uniform Transfers to Minors Act account, allows you to transfer assets to a minor without the need for a formal trust. The assets placed in a UTMA account are managed by a custodian until the minor reaches the age of majority, typically 18 or 21 years old, depending on state laws. This type of account provides a simple way to give children financial resources for education or other significant life expenses. Using our platform, you can easily create the necessary documents to establish an UTMA account and ensure your financial gifts are handled properly.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.