Get Standard Sale Of Property Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Standard Sale Of Property Form online

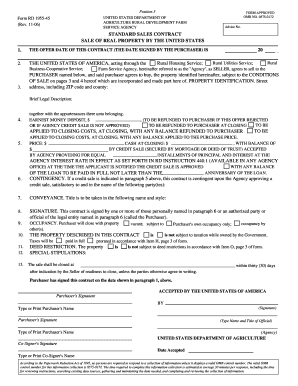

Filling out the Standard Sale Of Property Form can seem complex, but this guide will provide you with clear instructions to complete the process online effectively. This form is essential for purchasing real property from the United States, and understanding each component will help streamline your experience.

Follow the steps to complete your Standard Sale Of Property Form online.

- Click ‘Get Form’ button to receive the Standard Sale Of Property Form and open it in your preferred editor.

- Begin by entering the date of the offer in the designated section. This is the date you sign the contract as the purchaser.

- Input the property identification details. Provide the street address, ZIP code, and county where the property is located.

- Fill in the brief legal description of the property. Ensure this description accurately reflects the official documentation associated with the property.

- Complete the section for earnest money deposit. Specify the amount of the deposit and ensure clarity on conditions for its return.

- State the purchase price of the property and indicate any balance that is to be paid in cash at closing.

- If securing a credit sale, make sure to provide details regarding the financing terms and the necessary approvals.

- Specify the name in which the title should be taken. This is important for legal documentation.

- Provide the signature of the purchaser(s) along with the printed name for identification.

- If applicable, include co-signer details and their signature.

- Review all entries for accuracy before finalizing the form. Ensure all required fields are filled.

- Once complete, save your changes, and choose to download, print, or share the filled-out form as required.

Begin completing your Standard Sale Of Property Form online today for a streamlined property purchase experience.

You can obtain real estate forms from various sources, including online platforms like US Legal Forms. They provide a wide range of legally compliant documents, including the standard sale of property form, tailored to your specific needs. This resource simplifies the process, allowing you to access essential forms quickly and efficiently, ensuring you have the right tools for your property transactions. Choosing a reputable source ensures your forms meet local requirements, protecting your investment.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.