Get Ft 1001

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ft 1001 online

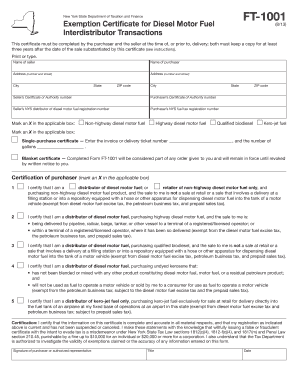

The Ft 1001 is an essential document for conducting interdistributor transactions of diesel motor fuel in New York State. This guide provides clear, step-by-step instructions on how to accurately complete this exemption certificate online.

Follow the steps to fill out the Ft 1001 effectively.

- Click 'Get Form' button to access the Ft 1001 online. This will enable you to view and complete the form in the editor.

- Begin by filling in the 'Name of seller' and 'Name of purchaser' fields. Ensure that you clearly indicate both parties involved in the transaction.

- Next, input the 'Address (number and street)' for both the seller and purchaser. Be sure to include the city, state, and ZIP code for both parties to provide complete information.

- Enter the 'Seller’s Certificate of Authority number' and 'Purchaser’s Certificate of Authority number.' This information is critical for verifying the legitimacy of the transaction.

- Complete the fields for 'Seller’s NYS distributor of diesel motor fuel registration number' and 'Purchaser’s NYS fuel tax registration number.' Both parties must hold valid registrations for the exemption to apply.

- Choose the appropriate type of fuel by marking an X in the applicable box, indicating either non-highway diesel motor fuel, highway diesel motor fuel, qualified biodiesel, or kero-jet fuel.

- Indicate whether you are using a single-purchase certificate or a blanket certificate by marking the corresponding box. If using a single-purchase certificate, enter the invoice or delivery ticket number and the number of gallons.

- Complete the 'Certification of purchaser' section by marking an X in the box that corresponds to your status as a distributor or retailer, ensuring that you provide an accurate representation of your purchase.

- Lastly, review the certification statement and ensure that you or an authorized representative signs the form. Include your title and the date of signing to validate the document.

- Once all fields are accurately completed, save your changes. You can then download the completed Ft 1001, print it, or share it as needed.

Complete your Ft 1001 online today to ensure compliance with New York State regulations!

Filing sales tax in Louisiana typically involves determining the appropriate tax rate for your sales and completing the necessary forms. The Ft 1001 outlines the steps for reporting your taxable sales and remitting the taxes owed. You can file online or through traditional paper methods, depending on your preference. For guidance on preparing your sales tax submissions, UsLegalForms offers efficient solutions tailored to your needs.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.