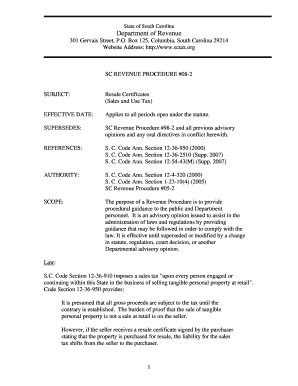

Get Sc Revenue Procedure #08 2 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Sc Revenue Procedure #08-2 Form online

This guide provides step-by-step instructions on how to accurately complete the Sc Revenue Procedure #08-2 Form online. Designed for users with varying levels of experience, this resource aims to simplify the filling process for your convenience.

Follow the steps to complete the form effectively

- Press the ‘Get Form’ button to access the form and open it in your editor.

- Begin with the seller's information section. Enter your name and address, including street, city, and zip code, as the seller.

- Proceed to the purchaser's information section. Fill in the purchaser's name and address, ensuring accuracy.

- Input the purchaser's South Carolina retail sales tax license number, or the respective number if they operate in another state.

- Describe the type of business the purchaser is engaged in. Include details that clarify the nature of the business.

- Provide a general list or description of the types of tangible personal property the purchaser sells, leases, or rents.

- Ensure the purchaser's signature is included. This can be from an individual owner, partner, member, or corporate officer.

- Lastly, enter the date the certificate was completed. Make sure this is accurate to avoid any issues.

- Once all fields are complete, review your entries for accuracy. After ensuring everything is correct, save changes, download, print, or share the completed form as needed.

Complete your documents online efficiently and ensure compliance with sales tax obligations.

Eligibility for tax exemption often depends on several factors including property ownership, income level, and age. In South Carolina, completing the SC Revenue Procedure #08 2 Form is crucial to evaluate your qualification for various tax exemptions. Exemptions can significantly lower tax liabilities for qualifying individuals. Therefore, it’s wise to gather documentation that supports your claim and consult official resources.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.