Get 51a154 Kentucky Revenue Department

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 51a154 Kentucky Revenue Department online

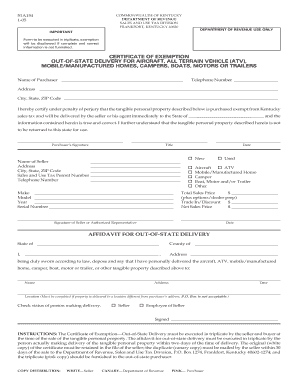

Filling out the 51a154 form from the Kentucky Revenue Department is an essential process for certifying exemption from sales tax on specific tangible personal property. This guide will provide clear and structured instructions for completing the form efficiently.

Follow the steps to complete the 51a154 form online.

- Click ‘Get Form’ button to access the document and open it in the editor.

- Begin by entering the name of the purchaser in the designated field. Ensure that the information is accurate and complete.

- Provide the purchaser's telephone number below their name to facilitate communication if needed.

- Fill in the complete address of the purchaser, including city, state, and ZIP code.

- In the section that begins with 'I hereby certify under penalty of perjury...', specify the state to which the property will be delivered.

- Sign in the field labeled 'Purchaser’s Signature.' Include the title of the signer and the date of signing.

- Input the name and address of the seller in the respective fields.

- Fill in the seller’s sales and use tax permit number, along with their telephone number.

- Select the type of property being purchased (aircraft, ATV, mobile/manufactured homes, etc.) and provide specific details, such as make, model, year, and serial number of the item.

- Enter the total sales price, any trade-ins or discounts, and the net sales price in the allocated fields.

- Ensure that the seller or authorized representative signs and dates the form.

- Complete the affidavit for out-of-state delivery section with the name and address of the individual delivering the property and the date of delivery.

- Check the status of the person making the delivery in the relevant section.

- Lastly, review all the entered information for accuracy before saving your changes, and ensure that the document is downloaded, printed, or shared as needed.

Complete your document online today for a seamless filing experience.

To obtain a tax-exempt number for your farm in Kentucky, you need to present your farm's qualifications to the 51a154 Kentucky Revenue Department. This typically involves filling out the farm tax exemption application form, which confirms your eligibility based on your farm's operations. After submitting the application with appropriate documentation, you'll receive your tax exempt number. Resources such as uslegalforms can aid in navigating this process smoothly.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.