Get Boe 267 H Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Boe 267 H Form online

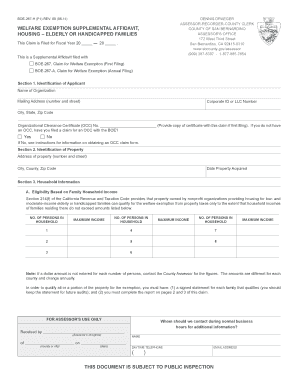

The Boe 267 H Form is a crucial document for non-profit organizations seeking a property tax exemption for housing designated for low and moderate-income elderly or handicapped families. This guide provides a clear, step-by-step approach to completing the form online, ensuring users have the necessary information to proceed confidently.

Follow the steps to complete the Boe 267 H Form online

- Press the ‘Get Form’ button to access the Boe 267 H Form and open it in your preferred digital document editor.

- In Section 1, provide the identification details of the applicant organization, including the name, mailing address, Corporate ID or LLC number, and the Organizational Clearance Certificate number, if applicable.

- For Section 2, enter the property identification details, including the address and date acquired.

- In Section 3A, indicate the number of persons in the household and their maximum income to determine eligibility based on household income. Ensure to verify the figures as they vary per county and change annually.

- Complete Section 3B by listing all qualified families residing at the property, including address, number of persons in each household, and their respective maximum income.

- In Section 3C, summarize the number of qualified and non-qualified families, ensuring that the total counts are accurate.

- For Section 3D, calculate the percentage of low and moderate-income families occupying the property relative to the total number of families.

- Provide your certification by signing and dating the form in the designated area.

- Finally, review your entries for accuracy, then save any changes you made, and proceed to download, print, or share the Boe 267 H Form as needed.

Complete the Boe 267 H Form online today to ensure your organization receives the necessary property tax exemptions.

Form BOE 266 is used in California for applying for a property tax exemption for certain properties. This form is crucial for obtaining assessment reductions based on specific eligibility criteria. Ensure you provide accurate information to process your exemption request smoothly. Understanding this form can complement your knowledge about the Boe 267 H Form, which may serve similar functions for other exemptions.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.