Loading

Get Raffle And/or Bazaar Tax Return - Hadleyma

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the RAFFLE AND/OR BAZAAR TAX RETURN - Hadleyma online

Filling out the RAFFLE AND/OR BAZAAR TAX RETURN - Hadleyma is an important process for organizations engaging in charitable activities. This guide will walk you through the necessary steps to complete the form accurately, ensuring compliance with Massachusetts tax regulations.

Follow the steps to complete your tax return online.

- Press the ‘Get Form’ button to access the RAFFLE AND/OR BAZAAR TAX RETURN form and open it in your preferred document editor.

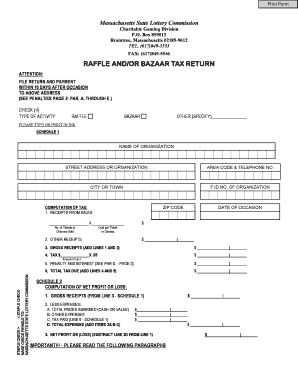

- Begin by selecting the type of activity by checking the appropriate box (Raffle, Bazaar, or Other) at the top of the form.

- Provide the name of the organization, street address, phone number, city or town, and Federal Identification Number (F.I.D. No.) in the designated fields.

- Move to Schedule 1 for the computation of taxes, starting with line 1 where you will enter the receipts from ticket sales. Multiply the number of tickets sold by the cost per ticket and record the amount.

- Record any other receipts on line 2 of Schedule 1.

- Calculate the gross receipts by adding lines 1 and 2 together and enter the result on line 3. Then, calculate the tax owed by multiplying gross receipts by 0.05 (5%) and write it on line 4.

- If applicable, calculate penalties and interest based on the provided guidelines and enter those amounts on lines 5 and 6 respectively.

- Proceed to Schedule 2 to compute net profit or loss. Start with the gross receipts noted from line 3 of Schedule 1.

- List all expenses including cash or equivalent prizes awarded, any other expenses incurred, and the tax paid from Schedule 1. Add these amounts together to determine total expenses.

- Subtract the total expenses from gross receipts to find net profit or loss and enter this in the designated space.

- Finally, ensure to declare the form under penalties of perjury by signing and dating it. Include your title and business contact information.

- Once the form is completed, you can save any changes, download it for your records, print a copy, or share it as required.

Complete your RAFFLE AND/OR BAZAAR TAX RETURN online today to ensure compliance and support your charitable efforts.

Yes, you must report and claim raffle winnings on your tax return. The IRS considers raffle winnings as taxable income, which is important for participants to understand. To simplify the process of reporting earnings, reviewing guidelines related to the RAFFLE AND/OR BAZAAR TAX RETURN - Hadleyma can provide valuable assistance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.