Loading

Get Bexar Form 50 128

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Bexar Form 50 128 online

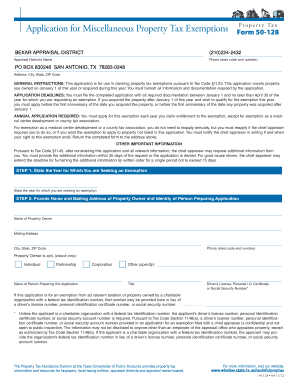

Filling out the Bexar Form 50 128 online is a straightforward process designed to help you apply for property tax exemptions. This guide will walk you through each section of the form, ensuring you provide all required information accurately and completely.

Follow the steps to complete your application successfully.

- Click ‘Get Form’ button to access the form and open it in the editor.

- State the year for which you are seeking an exemption. This is important as it determines the tax year for which you are applying.

- Provide the name and mailing address of the property owner, as well as the identity of the person preparing the application. Be sure to include a phone number.

- Check the type of exemption requested by selecting the applicable options from the list.

- Answer the questions about the organization applying for the exemption. Describe the organization’s purpose and activities, ensuring to attach any additional information as necessary.

- If applying as a county fair association, complete the additional questions specific to that type of organization.

- Describe the property for which you are seeking an exemption. Attach one Schedule A for each parcel of real property and a Schedule B listing all personal property.

- Read, sign, and date the application. Ensure that the signature is on behalf of the property owner and that the information provided is accurate to the best of your knowledge.

Submit your application online to begin your property tax exemption process.

To apply for a senior property tax exemption in Texas, you need to fill out the specific exemption application, which includes the Bexar Form 50 128. Provide the necessary information, such as your age and property details, to prove eligibility. It's essential to submit your application timely to benefit from the exemptions that apply to seniors.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.