Get Crown Castle Property Tax Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Crown Castle Property Tax Form online

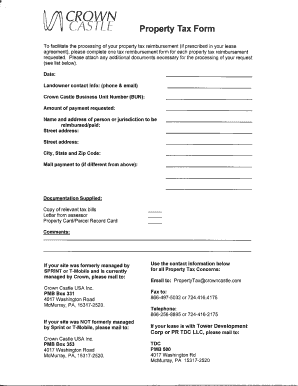

Completing the Crown Castle Property Tax Form online can streamline the process of managing your property taxes effectively. This guide offers clear instructions on how to fill out each section of the form, making it accessible for all users, regardless of their experience level.

Follow the steps to complete the form online:

- Access the form by pressing the ‘Get Form’ button to download it and open it in the digital editor.

- Begin by entering your personal information. Fill out your full name, address, and contact details in the designated fields. Ensure that the information is accurate to avoid delays.

- Provide property-specific details in the next section. This includes the property address, parcel number, and any other relevant identifiers. Double-check your entries for correctness.

- In the financial section, input your property tax assessment and any deductions you may qualify for. Carefully review this information, as it directly affects your tax calculations.

- Next, acknowledge your understanding of any declarations or legal statements included in the form. Ensure you read them thoroughly before proceeding.

- Finally, save your changes, and choose your preferred method to finalize the submission. You can download, print, or share the completed form as needed.

Take the next step in managing your property taxes by completing the Crown Castle Property Tax Form online today.

To obtain your property tax ID, you should first visit your local tax assessor's office or their website. They typically provide the necessary forms online or in person. In addition, using the Crown Castle Property Tax Form can simplify the process by allowing you to easily record your property information, ensuring you don’t miss any vital details. Once you have the correct information, submitting it ensures you receive your property tax ID without delay.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.