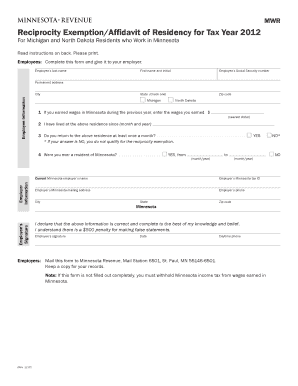

Get 2012 Reciprocity Exemptionaffidavait Of Residency For Tax Year Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2012 Reciprocity Exemption Affidavit of Residency for Tax Year Form online

Filling out the 2012 Reciprocity Exemption Affidavit of Residency for Tax Year Form online can simplify the process of claiming exemption from Minnesota income tax. This guide provides clear, step-by-step instructions to help users complete the form accurately and efficiently.

Follow the steps to complete the form online.

- Press the ‘Get Form’ button to access the 2012 Reciprocity Exemption Affidavit of Residency for Tax Year Form. Make sure the form opens in your web browser so you can start entering your information.

- Begin by filling in your personal information. This includes your last name, first name, and initial. Enter your Social Security number and your permanent address, including city, state, and zip code.

- In the employee information section, enter the wages you earned in Minnesota during the previous year. Use nearest dollar amounts for accuracy.

- Indicate how long you have lived at your current residence by providing the month and year.

- Answer the question regarding whether you return to your residence at least once a month. If the answer is 'No', you do not qualify for the reciprocity exemption.

- If applicable, declare any prior residency in Minnesota by providing the dates you were a resident.

- Sign and date the form to verify that the information is correct to the best of your knowledge. Include a phone number where you can be reached during the day.

- Submit the completed form to your employer and remind them to keep a copy for their records. Your employer will mail the form to Minnesota Revenue, ensuring it is sent to the correct address.

- Finally, you can save changes, download, print, or share the filled form based on your needs.

Complete your 2012 Reciprocity Exemption Affidavit of Residency for Tax Year Form online today to ensure your Minnesota income tax exemption.

To prove your tax residency in the US, you should compile evidence showing your physical presence and ties to the state. Collect official documents, such as lease agreements and financial statements, that confirm your address. Utilizing the 2012 Reciprocity Exemption Affidavit Of Residency For Tax Year Form can aid in presenting your residency case effectively.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.