Loading

Get Cardholder Dispute Affidavit Of Fraud - Chcu . Org - Chcu

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Cardholder Dispute Affidavit Of Fraud - CHCU . Org - Chcu online

Filling out the Cardholder Dispute Affidavit of Fraud is a crucial step for users wishing to dispute unauthorized transactions on their credit, debit, or ATM cards. This comprehensive guide provides step-by-step instructions to help users navigate the form easily.

Follow the steps to complete your Cardholder Dispute Affidavit of Fraud.

- Click ‘Get Form’ button to obtain the form and open it in the editor to start your dispute.

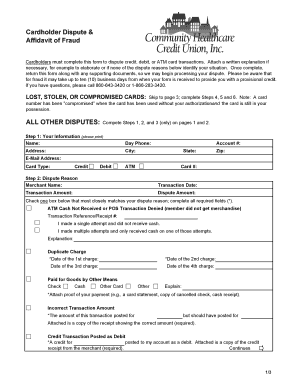

- Begin by providing your personal information. Fill in your name, daytime phone number, address, city, state, zip, email address, card type (credit or debit), card number, and account number as required in the specified fields.

- Next, select a dispute reason by identifying the merchant name, transaction date, and amounts involved. Provide detailed information based on the nature of your dispute. Make sure to check the appropriate box that describes your situation and complete any related fields.

- If your card was lost, stolen, or compromised, skip to page 3 and complete Steps 4, 5, and 6 as directed. This section requires additional information about unauthorized charges, including details of each transaction and any relevant police report if applicable.

- Once all information has been entered, review the details to ensure accuracy. Then, provide your signature and date in the designated sections to certify that the information is correct.

- Finally, save your changes, and you may choose to download, print, or share the form as required for submission along with any supporting documents.

Start filling out your Cardholder Dispute Affidavit of Fraud online today to address unauthorized transactions.

The bank will conduct a preliminary investigation. If the cardholder's claim seems valid, they will issue a provisional credit and return the funds to the customer's bank account. They will then recoup the money by initiating a debit card dispute with the merchant.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.