Loading

Get L-4 Employee's Withholding Allowance Certificate - Bpcc

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the L-4 Employee's Withholding Allowance Certificate - Bpcc online

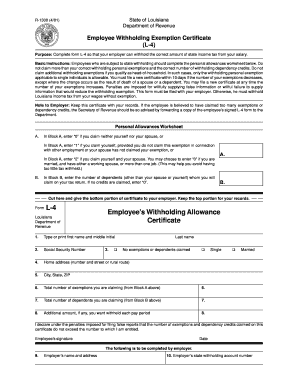

The L-4 Employee's Withholding Allowance Certificate is a vital form used to determine the correct amount of state income tax to be withheld from your salary. Completing this form accurately ensures that you avoid overpaying or underpaying your taxes throughout the year.

Follow the steps to complete the L-4 form online:

- Click ‘Get Form’ button to obtain the L-4 Employee's Withholding Allowance Certificate and open it in the editor.

- In the first section, enter your first name and middle initial in the corresponding field.

- Next, provide your last name as well as your Social Security number in the designated fields.

- Complete your home address, including your street address, city, state, and ZIP code.

- In Block A, determine the number of exemptions you are claiming. Enter '0', '1', or '2' based on your individual situation, as instructed.

- In Block B, specify the number of dependents you will claim on your tax return. If none, enter '0'.

- For the total number of exemptions claimed, fill in the corresponding number from Block A in Field 6.

- Then, record the total number of dependents from Block B in Field 7.

- If you wish to have an additional amount withheld each pay period, specify that amount in Field 8.

- After completing the form, sign and date it to declare the accuracy of the information provided.

- Cut the bottom portion of the certificate and submit it to your employer, while retaining the top portion for your records.

Complete your L-4 form online today to ensure accurate state tax withholding.

Related links form

Retrieving your withholding certificate can be done by contacting your employer’s HR department, or you can check your online employee account if your company provides such a feature. If you are looking to pull up an old form, you can also request a copy from the US Legal Forms platform, which provides easy access to crucial tax documentation.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.