Loading

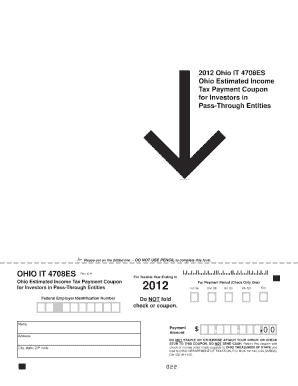

Get Ohio It 4708es Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ohio It 4708es Form online

Filling out the Ohio It 4708es Form online can simplify your tax filing process. This guide provides clear and detailed steps to assist you in completing the form accurately and efficiently.

Follow the steps to successfully complete the form.

- Press the ‘Get Form’ button to access the Ohio It 4708es Form and open it in your preferred editor.

- Begin by entering your personal information in the designated fields, including your name, address, and social security number. Ensure that all information is accurate and matches your official documents.

- Proceed to the section regarding your tax year. Indicate the appropriate year for the tax filings you are addressing with this form.

- Review any applicable deductions or credits that may apply to your situation. Enter this information in the relevant sections to maximize your tax benefits.

- Double-check all entries for accuracy and completeness. It is essential to ensure that there are no mistakes before proceeding.

- Once all fields are complete, you can save changes, download a copy of the form, print it, or share it as needed.

Start completing your Ohio It 4708es Form online now.

Yes, you can file an amended return electronically in Ohio using the appropriate forms, including the Ohio IT 4708es Form if applicable. This process simplifies corrections to your initial filing. The convenience of electronic filing ensures that your amendments are handled efficiently. Explore more about this process on the US Legal Forms platform for easier navigation through the requirements.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.