Loading

Get Predominant Place Of Employment

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Predominant Place Of Employment online

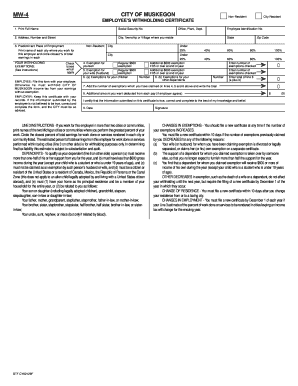

Filling out the Predominant Place Of Employment form is an essential step in ensuring accurate tax withholding. This guide provides clear, step-by-step instructions to help you navigate the online process easily.

Follow the steps to complete the form effectively.

- Click ‘Get Form’ button to obtain the form and open it in your preferred online editor.

- Enter your full name in the designated field at the top of the form. Make sure the name matches the one used on your Social Security card.

- Fill in your residential address, including the number and street, city, township, or village where you reside.

- In the section labeled 'Predominant Place Of Employment', list the cities where you work for your employer. Include the names of each city and circle the percentage of total earnings that corresponds to work done in each location.

- Mark the appropriate checkboxes under 'YOUR WITHHOLDING EXEMPTIONS' to indicate which exemptions apply to you, including yourself, your partner, and other dependents.

- Calculate and enter the total number of exemptions claimed from lines 4, 5, and 6. This total is important for calculating proper withholding amounts.

- If you wish to have an additional amount deducted from each paycheck, specify that amount in the provided field. Ensure that your employer approves this deduction.

- Sign and date the form to certify that the information you submitted is accurate and complete.

- Once all fields are completed, save your changes. You can download, print, or share the form as needed for your records or for submission to your employer.

Complete your Predominant Place Of Employment form online to ensure accurate tax withholding today.

A place of employment refers to the specific location where an employee performs their job duties. This can be a physical building, a remote work setting, or a designated area where business activities occur. Understanding the concept of a predominant place of employment is essential for various legal and tax-related matters.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.