Loading

Get 999 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 999 Form online

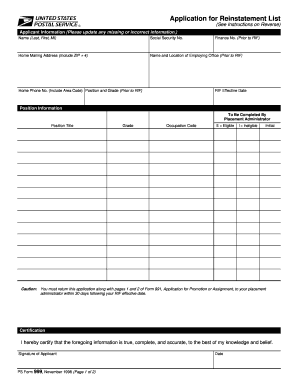

Completing the 999 Form online is a crucial step for individuals seeking reinstatement after a reduction-in-force. This guide provides comprehensive instructions for users to accurately fill out the form, ensuring all necessary information is provided.

Follow the steps to successfully complete the 999 Form online.

- Use the ‘Get Form’ button to access the 999 Form and open it in the online editor.

- Begin by entering applicant information. Ensure to fill in your full name, including your last name, first name, and middle initial. Also, provide your Social Security number and home mailing address, including ZIP + 4.

- Next, complete the section for the name and location of your employing office prior to the reduction-in-force. Include your home phone number with the area code.

- Indicate your previous position and grade before the reduction-in-force. Include your Finance number and the date your RIF became effective.

- Proceed to the Position Information section. Here, the placement administrator will assist you. Specify the position title, grade, and occupation code for the positions you are eligible for, marking 'E' for eligible or 'I' for ineligible.

- In the Certification section, verify that all information filled out is accurate to the best of your knowledge. Sign and date the form.

- Remember to return the completed 999 Form along with pages 1 and 2 of Form 991 to your placement administrator within 30 days of your RIF effective date.

- Finally, save your changes, download a copy of the form for your records, and consider printing or sharing the form as needed.

Start completing your 999 Form online today to ensure your eligibility for reinstatement.

If you haven’t received your 1099 form, the first step is to contact the payer directly. They may have sent it to an incorrect address or failed to issue it. If you still encounter challenges, consider using uslegalforms to help obtain your form and ensure accurate filing.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.