Loading

Get New Hire Reporting Form Note: All New ... - Checkmate Payroll

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NEW HIRE REPORTING FORM Note: All New ... - Checkmate Payroll online

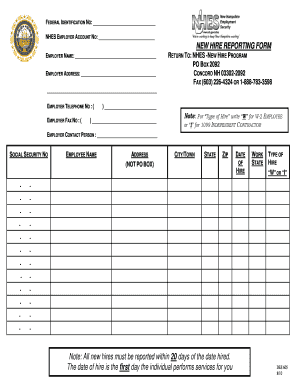

The New Hire Reporting Form is essential for employers to report new hires efficiently. This guide will provide step-by-step instructions to help you complete the form accurately and promptly.

Follow the steps to successfully complete the New Hire Reporting Form

- Press the ‘Get Form’ button to access the New Hire Reporting Form and open it for editing.

- Fill in the federal identification number in the designated field. This number identifies your business for tax purposes.

- Enter the NHES employer account number in the respective field for reporting requirements.

- Input the employer's name and address in the indicated areas to provide necessary contact information.

- Provide the employer's telephone number and fax number in the specified fields for communication purposes.

- Determine the type of hire by writing 'W' for W-2 Employee or 'I' for 1099 Independent Contractor in the corresponding section.

- Complete the employer contact person's name and their details to ensure proper reporting.

- Fill in the new hire's social security number accurately in the specified field.

- Document the work state where the new hire will perform their duties.

- Provide the date of hire, which is the first day the individual starts working.

- Enter the employee's address, ensuring it is not a P.O. Box, and include the city or town, state, and zip code.

- Review all filled-out information for accuracy and completeness.

- After verifying the details, save changes, download, print, or share the completed form as needed.

Complete the new hire reporting form online today to ensure timely compliance.

When beginning a new job, two critical forms new hires must complete are the W-4 and the NEW HIRE REPORTING FORM. The W-4 helps determine the amount of tax withheld from an employee's paycheck, while the NEW HIRE REPORTING FORM informs state agencies of their hiring. Ensuring these forms are filled out accurately supports both the employee and employer's interests.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.