Loading

Get Nr Af1

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Nr Af1 online

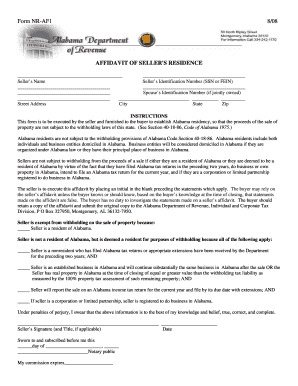

Filling out the Nr Af1 form accurately is essential for establishing residency status in Alabama when selling property. This guide will walk you through each section of the form to ensure you complete it correctly and efficiently.

Follow the steps to complete the Nr Af1 form online.

- Click the 'Get Form' button to access the form and open it in your preferred online editor.

- Begin filling out the seller’s name section. Enter the full name of the seller as it appears on official identification documents.

- Review the instructions regarding residency status. If applicable, check the box indicating the seller's residency status as either a resident of Alabama or deemed a resident based on the outlined criteria.

- In the seller's signature section, the seller must sign and date the form, ensuring that all information provided is accurate to the best of their knowledge.

- Finally, review the completed form for accuracy, save any changes, and prepare to download, print, or share the form as required. Retain a copy for the seller's records.

Complete your documents online today for a smooth filing process.

To obtain Alabama tax forms, you can visit the official Alabama Department of Revenue website. There, you will find a range of forms, including those for income tax and business taxes. Additionally, you may consider using the Nr Af1 feature on USLegalForms, which simplifies the process by providing easy access to state-specific forms. This ensures you have the right documents at your fingertips.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.