Loading

Get Ftb 5722

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ftb 5722 online

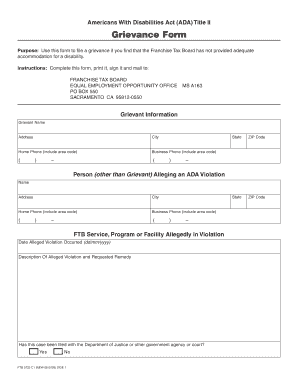

The Ftb 5722 is an important form for individuals seeking to file a grievance related to inadequate accommodation under the Americans With Disabilities Act. This guide will provide clear, step-by-step instructions on how to fill out the form online to ensure a smooth submission process.

Follow the steps to successfully complete the Ftb 5722 online.

- Click ‘Get Form’ button to access the form and open it in your preferred editor.

- In the 'Grievant Information' section, provide your full name, address, city, state, ZIP code, and both your home and business phone numbers, including area codes.

- If there is a person other than yourself alleging an ADA violation, fill in their name, address, city, state, ZIP code, and phone numbers in the designated fields.

- Identify the FTB service, program, or facility that is allegedly in violation. Include the date the alleged violation occurred in the format dd/mm/yyyy.

- Provide a detailed description of the alleged violation and the remedy you are requesting in the appropriate section.

- Indicate whether this case has been filed with the Department of Justice or another government agency or court by selecting 'Yes' or 'No.'

- If you answered 'Yes', complete the additional fields with the agency or court name, contact person, their address, and the date you filed the grievance.

- Add any other comments you wish to include in the designated field.

- Lastly, sign the form and enter the date before saving, downloading, printing, or sharing the completed form as needed.

Complete your forms online for a seamless experience.

Related links form

Whether you will receive an FTB supplement depends on your eligibility based on your income and circumstances. This supplement can provide vital financial support, enhancing your tax refund or relief. Understanding the qualifying factors for FTB 5722 is crucial for optimizing your benefits. US Legal Forms can help you navigate through this process efficiently.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.