Loading

Get Wautauga County Occupancy Tax Return Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Wautauga County Occupancy Tax Return Form online

Completing the Wautauga County Occupancy Tax Return Form online is a straightforward process that helps ensure compliance with local tax regulations. This guide will walk you through each step to accurately fill out and submit your tax return.

Follow the steps to successfully complete your occupancy tax return online.

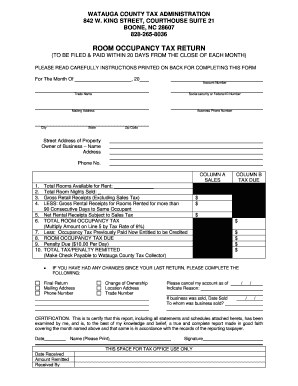

- Use the ‘Get Form’ button to access the occupancy tax return form and open it for editing.

- Fill in the month and year for which you are filing. Ensure this information reflects the accurate reporting period.

- Enter your account number associated with the occupancy tax. This number helps identify your records.

- Provide the trade name of your business as it is registered. This identifies your business in the records.

- Input your social security number or federal ID number, whichever is applicable. This is for identification purposes.

- Fill in your mailing address, business phone number, city, state, and zip code to ensure proper communication.

- Input the street address of the property where rentals are occurring. This should be the location being reported.

- Provide the owner's name of the business, along with their address and phone number, for contact purposes.

- Complete COLUMN A by documenting the total number of rooms available for rent, the total room nights sold, and gross retail receipts (excluding sales tax). These figures are key to calculating your tax liability.

- Calculate the net rental receipts by subtracting the gross rental receipts for rooms rented for more than 90 consecutive days from the gross retail receipts.

- Multiply the net rental receipts by the tax rate of 6% to determine the total room occupancy tax due.

- If applicable, deduct any occupancy tax previously paid that you are entitled to credit against your current return.

- Calculate the total tax and penalties due. Include any penalties for late filing at ten dollars per day post the due date.

- After reviewing your entries for accuracy, save your changes, download or print the form for your records, and ensure that you submit it to the tax office as required.

Complete your Wautauga County Occupancy Tax Return Form online today to stay compliant and avoid penalties.

Generally, occupancy tax is not deductible on your income tax return, as it is passed on to public authorities. However, if you operate a rental business, you may deduct other business-related expenses. For accurate filing, review regulations and ensure all applicable items are documented when submitting your Watauga County Occupancy Tax Return Form.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.