Loading

Get Quarterly Report Of Surplus Lines Business Nebraska Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Quarterly Report Of Surplus Lines Business Nebraska Form online

The Quarterly Report Of Surplus Lines Business Nebraska Form is essential for reporting surplus lines business transactions. Filling this form out online can simplify the process and ensure accurate submission.

Follow the steps to complete the form accurately and efficiently.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

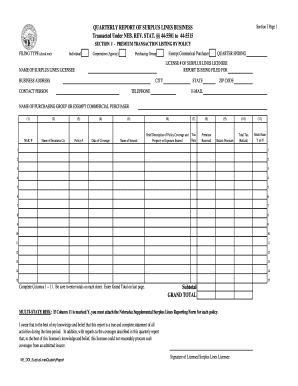

- Identify the filing type at the top of the form. Select one option: Individual, Corporation (Agency), Purchasing Group, or Exempt Commercial Purchaser.

- Enter the quarter ending date to indicate the reporting period.

- Fill in the license number of the surplus lines licensee who is filing the report.

- Provide the name and business address of the surplus lines licensee, including city, state, ZIP code, and contact information.

- Include the name of the purchasing group or exempt commercial purchaser if applicable.

- Complete the premium transaction listing by filling out columns 1-11 for each policy, which includes NAIC number, name of insurance company, policy number, date of coverage, name of the insured, brief description of policy coverage, tax rate, premium received, return premium, total tax, and indicate if it's a multi-state risk.

- Ensure all totals are calculated accurately and entered on each sheet, along with the grand total on the last page.

- If any multi-state risks are indicated, attach the Nebraska Supplemental Surplus Lines Reporting Form for each relevant policy.

- Sign and date the report affirming that it is true and complete to the best of your knowledge.

- Once all fields are filled out and verified, save the changes, download, print, or share the completed form as necessary.

Complete your documents online today for efficient and accurate filing.

Currently, the tax rate for supplemental bonuses in 2025 has not yet been finalized. However, it often aligns with prevailing tax policies established in previous years. To prepare for changes, keep an eye on announcements from state authorities and review your Quarterly Report Of Surplus Lines Business Nebraska Form regularly. Using resources from USLegalForms can help you stay informed of such updates and tax implications.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.