Loading

Get Virginia Form 502v

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Virginia Form 502v online

This guide provides clear and comprehensive instructions for filling out the Virginia Form 502v online. Designed to assist users with little legal experience, the following steps will help ensure that your form is completed accurately and efficiently.

Follow the steps to complete the Virginia Form 502v online.

- Press the ‘Get Form’ button to obtain the Virginia Form 502v and open it for editing.

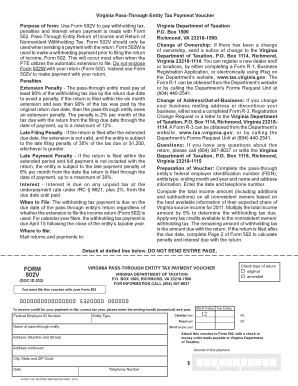

- Fill in the federal employer identification number (FEIN) of the pass-through entity. This unique identifier is essential for processing your payment correctly.

- Indicate the entity type by selecting the appropriate option from the provided list. Ensure this reflects your business structure accurately.

- Enter the name of the pass-through entity, providing the full legal name as it appears in official records.

- Specify the fiscal year or check the box for calendar year reporting. This information is crucial for determining tax obligations.

- Complete the address section by providing your business location details, ensuring all information is accurate and up-to-date.

- Record the date and telephone number for your entity to facilitate any potential follow-up or inquiries.

- Compute the total income amount for nonresident owners based on available information, and multiply by 5% to determine the withholding tax due.

- Apply any available tax credits to the withholding tax, ensuring that the remaining amount due is clearly recorded.

- If applicable, complete Page 2 of Form 502 to calculate any penalties and interest due if the return is filed after the due date.

- Lastly, review all entries for accuracy, and then save changes. You may choose to download, print, or share the final form as needed.

Start filling out your Virginia Form 502v online today to ensure timely and accurate tax payment.

To file a Virginia tax extension, submit Form 759 to the Virginia Department of Taxation. This allows you to extend your filing deadline. Using tools from uslegalforms can help ensure you complete this process correctly, giving you the extra time needed to file your Virginia Form 502v.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.