Loading

Get Form 451

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 451 online

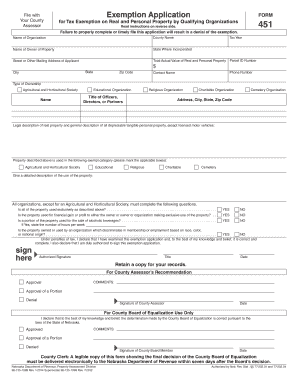

Filling out the Form 451 online simplifies the process of applying for tax exemption on real and personal property for qualifying organizations. This guide will provide clear, step-by-step instructions tailored to support users of all experience levels in completing this essential form.

Follow the steps to fill out Form 451 online effectively.

- Press the ‘Get Form’ button to access the Form 451, making it available for you to work on it online.

- Begin by entering the tax year for which you are applying for the exemption.

- Provide the name of your organization in the designated field.

- Indicate the county name where the property is located.

- Enter the name of the owner of the property.

- Fill in the state where your organization is incorporated.

- Complete the mailing address for your organization, including street, city, state, and zip code.

- Report the total actual value of your real and personal property in the specified field.

- Include the parcel ID number associated with the property.

- List the phone number and contact name for your organization.

- Select the type of ownership from the options provided, such as agricultural and horticultural society, educational organization, religious organization, charitable organization, or cemetery organization.

- Fill in the titles of officers, directors, or partners of your organization.

- Provide the legal description of the real property and a general description of all depreciable tangible personal property, except licensed motor vehicles.

- Mark the applicable boxes that describe how the property is used.

- Offer a detailed description of the property's use.

- Answer the subsequent questions regarding exclusive use, financial gain, and compliance with non-discrimination laws.

- Sign and date the form in the authorized signature area.

Complete your Form 451 online today to ensure timely submission for your property tax exemption.

To obtain an E-1 form online, simply visit the US Legal Forms website. Search for the E-1 form, and once you locate it, you can either download it or fill it out directly online. This convenience allows you to access important documents without hassle, making the process quick and user-friendly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.