Get Maricopa Property Tax Classification2012 Appeal Formresidential Reclassification Notorized

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Maricopa Property Tax Classification 2012 Appeal Form for residential reclassification online

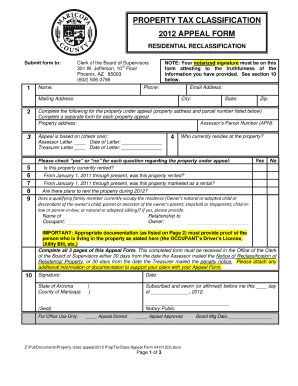

This guide provides clear and supportive instructions on how to accurately complete the Maricopa Property Tax Classification 2012 Appeal Form for residential reclassification. Following these steps will help ensure that your form submission is correct and complete, facilitating a smooth appeal process.

Follow the steps to successfully complete your form online.

- Press the ‘Get Form’ button to access the Maricopa Property Tax Classification 2012 Appeal Form and open it in the editor.

- Begin by filling in your personal information, including your name, address, and contact details. Ensure all entries are accurate to prevent delays in processing.

- Provide the property details, such as the property identification number and the address of the property you are appealing. This information must match public records.

- Specify the reason for your appeal in the designated section. Be clear and concise, providing any necessary evidence to support your claim.

- Review any additional documentation required, ensuring all attachments are included. This may include evidence of property tax classification or assessments.

- Once all fields are filled out, carefully review your entries to confirm accuracy and completeness.

- After finalizing your form, choose to save changes, download, print, or share the completed document as required.

Complete your documents online to ensure a seamless filing experience.

The tax class action lawsuit in Maricopa County aims to address systemic issues related to property tax assessments. Residents may participate if they believe their property taxes are unfairly high compared to similar properties. To effectively engage in this process, gather your Maricopa Property Tax Classification2012 Appeal Formresidential Reclassification Notorized and relevant data. Participation can lead to substantial benefits for community members.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.