Loading

Get Form Mw-507. Employees Maryland Withholding Exemption Certificate - Transition Usaid

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form MW-507. Employees Maryland Withholding Exemption Certificate - Transition Usaid online

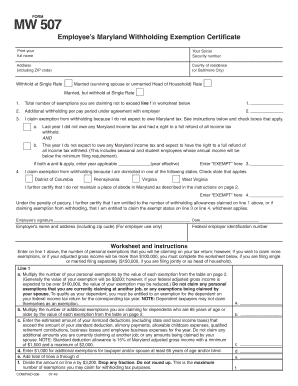

The Form MW-507 is an important document that enables employees in Maryland to claim withholding exemptions. This guide provides clear, step-by-step instructions for filling out the form online, ensuring that users can effectively complete it to suit their tax needs.

Follow the steps to accurately complete the form.

- Use the ‘Get Form’ button to access the form in your preferred editing platform.

- Begin filling out the form by entering your full name, Social Security number, and address, including ZIP code. Specify your county of residence or Baltimore City.

- Indicate your withholding rate by checking the appropriate box: either 'Withhold at Single Rate' or 'Married (surviving spouse or unmarried Head of Household) Rate.'

- In line 1, enter the total number of exemptions you are claiming. This number should not exceed the maximum allowed as stated in the accompanying worksheet.

- For line 2, if you wish to request additional withholding per pay period that has been discussed with your employer, enter the desired amount here.

- For line 3, check the box if you are claiming exemption from withholding due to expecting no Maryland tax liability. Ensure that both conditions a and b are applicable before entering 'EXEMPT' in the space provided.

- In line 4, select if you claim exemption based on being domiciled in one of the relevant states (District of Columbia, Pennsylvania, Virginia, or West Virginia). Enter 'EXEMPT' here if this applies.

- Sign and date the form, certifying that the information provided is truthful and accurate. Your signature is required under the penalty of perjury.

- Finally, check any additional instructions and save your changes. You can now download, print, or share the completed form as needed.

Complete your Form MW-507 online today to ensure your Maryland withholding exemptions are correctly filed.

To obtain a Maryland tax exempt certificate, you need to complete the Form MW-507 and provide it to your employer. This certificate will signify your exemption status and allow your employer to adjust your withholding accordingly. For assistance, USLegalForms can help you navigate the process and ensure compliance with Maryland tax regulations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.