Get Td F 90-22-47 Bank Sar May 2000 - Ffiec - Ffiec

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the TD F 90-22-47 Bank SAR May 2000 - FFIEC - Ffiec online

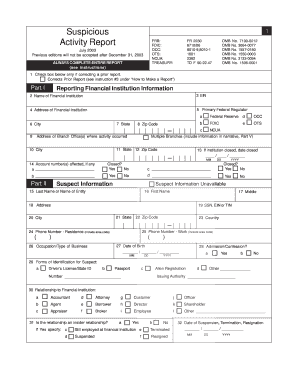

Filling out the TD F 90-22-47 Bank Suspicious Activity Report (SAR) can be a critical task for financial institutions. This guide will help users understand the process of completing the form online, ensuring accuracy and compliance with federal regulations.

Follow the steps to successfully complete the form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering Reporting Financial Institution Information. Input the name, Employer Identification Number (EIN), address, and primary federal regulator.

- Proceed to provide Suspect Information. Fill in the last name, first name, middle initial, address, social security number (SSN) or tax identification number (TIN), and any relevant phone numbers.

- In the Suspicious Activity Information section, enter the total dollar amount involved in the suspicious activity and the date range of the activity.

- Summarize the characterization of the suspicious activity by selecting from the provided options, such as money laundering or identity theft.

- Complete the Contact for Assistance section, entering the preparer's name, title, and contact details.

- In Part V, provide a detailed explanation of the known or suspected violation, adhering to the checklist provided for thoroughness.

- Review all entries for accuracy and completeness before submitting the report.

- Finally, you can save the changes, download, print, or share the completed form as needed.

Complete your documents online today to stay compliant and efficient.

Related links form

A suspicious transaction refers to any financial activity that appears to lack a lawful purpose or is not consistent with a customer's known business. It may include unusually large deposits, rapid fund transfers to multiple accounts, or transactions involving funds from unknown sources. According to the guidelines provided in the TD F 90-22-47 Bank SAR May 2000 - FFIEC - Ffiec, banks are obligated to investigate such activities and file a SAR when necessary.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.