Loading

Get Form L2068

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form L2068 online

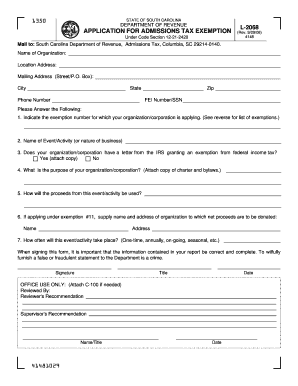

Filling out the Form L2068 is a crucial step for organizations seeking an admissions tax exemption in South Carolina. This guide will provide you with clear and detailed instructions to help you complete the form accurately and efficiently.

Follow the steps to successfully complete the Form L2068 online.

- Click the 'Get Form' button to access the form and open it in your preferred online editor.

- Provide the name of your organization in the designated field. Ensure this matches any official documentation you possess.

- Fill out the mailing address section, using either a street address or P.O. Box, city, state, and zip code.

- Input your organization's phone number for contact purposes.

- Provide your FEI number or Social Security Number (SSN) in the specified field.

- Indicate the exemption number for which your organization is applying, referring to the list of exemptions provided on the reverse side of the form.

- List the name of the event or activity related to the application in the corresponding field.

- Answer whether your organization has received a letter from the IRS granting an exemption from federal income tax by selecting 'Yes' or 'No.' If 'Yes,' attach a copy.

- Describe the purpose of your organization. It may be necessary to attach copies of your charter and bylaws for verification.

- Explain how the proceeds from the event or activity will be utilized.

- If applying under exemption #11, provide the name and address of the organization to which net proceeds will be donated.

- Specify how often the event or activity will occur (e.g., one-time, annually, ongoing, seasonal).

- Sign and date the form to confirm that all information is complete and accurate. Make sure to include your title.

- After completing all sections, review the form for accuracy. You may then save your changes, download, print, or share the form as needed.

Take the necessary steps to complete the Form L2068 and ensure your organization's eligibility for the admissions tax exemption online.

Filing Form 10IEA is often necessary depending on your tax situation. If your income exceeds a specific threshold or if you're claiming certain deductions, then it is mandatory. For clarity on the requirements, refer to Form L2068 and consult the official guidelines.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.