Get Form Sc8453

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form SC8453 online

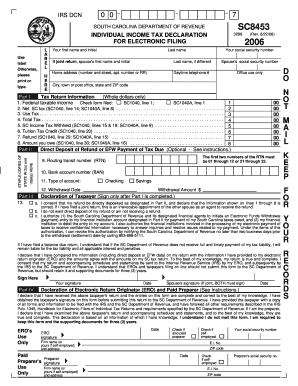

This guide provides comprehensive instructions on how to successfully complete the Form SC8453 for electronic filing of your South Carolina individual income tax. Follow these steps to ensure your document is filled out accurately and ready for submission.

Follow the steps to complete your Form SC8453 online.

- Use the ‘Get Form’ button to access the Form SC8453. Open it in your preferred online editor to begin filling it out.

- Enter your personal information in the designated fields at the top of the form. This includes your first name, last name, and social security number. Ensure the information is accurate as it will be used for identification.

- Continue by filling in your home address, daytime telephone number, and if applicable, your spouse's information if you are filing a joint return.

- Move to Part I of the form, where you will input the required tax return information derived from your South Carolina tax return. Make sure to enter the values in whole dollars.

- In Part II, specify how you would like to manage the payment and direct deposit options. If you're opting for direct deposit, complete the routing transit number and bank account details.

- As you reach Part III, you need to declare your preferences regarding your tax refund or payment. Carefully select the appropriate declaration.

- After completing the necessary fields, proceed to sign the form. If applicable, your spouse should sign as well if you are filing jointly.

- In Part IV, if you have an electronic return originator, they will fill out the declaration section regarding the accuracy of the information provided.

- Finally, ensure all signatures are in place. After completing the form, you can save your changes, download, or print it for your records.

Complete your Form SC8453 online today for a smooth electronic filing experience.

Filling in a tax residency self-certification form requires you to provide your personal information, including your name, address, and tax identification number. You should also declare your country of tax residency and confirm your tax status. Review the form to ensure accuracy to avoid any complications. To assist you, UsLegalForms offers helpful tools and templates for effectively completing your tax residency self-certification form.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.