Loading

Get Treasurer State Of Connecticut Charitable Renewal Registration Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Treasurer State Of Connecticut Charitable Renewal Registration Form online

Filing the Treasurer State Of Connecticut Charitable Renewal Registration Form online is a straightforward process. This guide will provide you with clear instructions to ensure you complete the form accurately and efficiently.

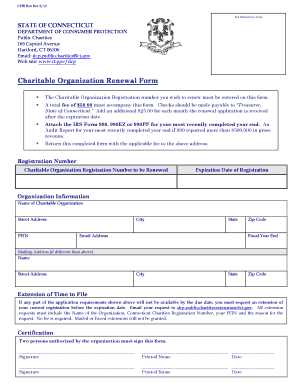

Follow the steps to complete your registration renewal online

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Enter the charitable organization registration number that you wish to renew in the designated field.

- Provide the expiration date of your current registration to verify the renewal timeline.

- Fill out the organization information section, including the name, city, street address, FEIN, state, email address, zip code, and fiscal year end.

- If your mailing address is different from the street address, include the new mailing address details in the provided fields.

- Prepare to attach the IRS Form 990, 990EZ, or 990PF for your most recently completed year end. If your organization reported more than $500,000 in gross revenue, include the audit report as well.

- Certify the application by having two authorized persons from your organization sign the form, ensuring that their printed names and the dates of signing are included.

- Check that the total fee of $50.00 is included with the form, making checks payable to 'Treasurer, State of Connecticut.' Remember to add an additional $25.00 for each month if the application is submitted after the expiration date.

- Once you have completed all sections, save the changes, and prepare to download or print the form.

- Submit the completed form along with the applicable fee to the Department of Consumer Protection at the provided address.

Complete your charitable renewal registration online today for a seamless process.

Related links form

Yes, charitable contributions made to federally recognized non-profit organizations may be deductible on your Connecticut state tax return. This depends on various factors, such as your income and tax filing status. To maximize your tax benefits, ensure your organization is registered properly with the state using the Treasurer State Of Connecticut Charitable Renewal Registration Form.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.