Get Salestaxexemptionsdormogov Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Salestaxexemptionsdormogov Form online

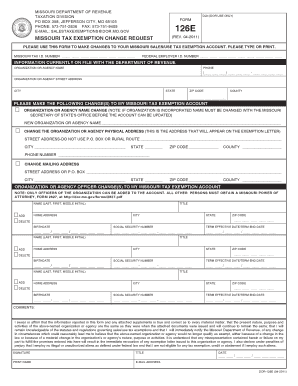

Completing the Salestaxexemptionsdormogov Form is a vital process for those seeking to make changes to their Missouri sales and use tax exemption accounts. This guide will provide clear, step-by-step instructions to help users fill out the form accurately and efficiently.

Follow the steps to successfully complete the Salestaxexemptionsdormogov Form.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your Missouri Tax I.D. number in the specified field. This number is crucial for identifying your exemption account.

- Input your Federal Employer I.D. number in the designated area. This helps to ensure your organization's details are accurate.

- In the section titled 'Information currently on file with the Department of Revenue', provide the name of your organization or agency, along with its phone number, street address, city, state, zip code, and county.

- Specify the changes you wish to make to your Missouri tax exemption account. You can change your organization name, address, or mailing address. Make sure to fill in all required fields for the changes you request.

- If adding or deleting officers from your organization, fill in the appropriate details, including their name, home address, title, and relevant dates.

- In the comments section, provide any additional information that may be pertinent to your changes.

- The person authorized to make these changes must sign the form. Include their title, printed name, email address, and the date of completion. Remember, digital signatures are not accepted.

- Review all entered information for accuracy before finalizing. Once completed, you can save the changes, download, print, or share the form as needed.

Start filling out your Salestaxexemptionsdormogov Form online today to ensure your Missouri tax exemption account is up-to-date.

Yes, you can claim exempt on your tax forms if you qualify for certain exemptions. To do this, you will need to complete the Salestaxexemptionsdormogov Form, which allows you to declare your exempt status officially. It's crucial to ensure that you meet all the eligibility criteria to avoid potential tax issues later. Consider using our platform at uslegalforms to easily access this form and navigate the exemption process smoothly.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.