Loading

Get Michigan Form 4133

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Michigan Form 4133 online

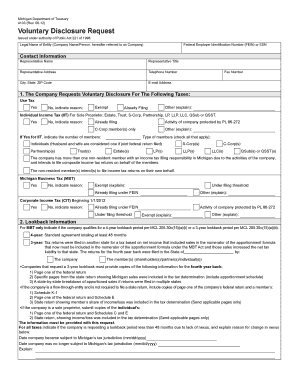

Filling out the Michigan Form 4133—Voluntary Disclosure Request—online can seem daunting, but with the right guidance, it can be straightforward. This guide provides detailed and step-by-step instructions to assist users in successfully completing the form.

Follow the steps to fill out the Michigan Form 4133 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by completing the 'Legal Name of Entity' section with the official name of your company or the person making the request. This information is essential for identifying your entity.

- In Section 1, indicate whether your company requests voluntary disclosure for specific taxes like Use Tax, Individual Income Tax for Sole Proprietor, and Michigan Business Tax. Clearly check 'Yes' or 'No' for each tax and provide reasons as applicable.

- For the 'Lookback Information' section, indicate the applicable lookback period for the Michigan Business Tax and provide relevant dates and explanations if your company changed its nexus status.

- Complete Company Information Necessary for Agreements by answering the series of questions regarding your company’s tax situation, ownership interests, and operational details. Provide details such as tax types you pay and the federal return type filed.

- For 'Requirements' section, ensure you answer truthfully to avoid disqualification for voluntary disclosure. Mark 'Yes' or 'No' for statements related to audits, contacts with the Department of Treasury, or any legal proceedings.

- Once all sections are completed, review the form for accuracy. You can then save changes, download, print, or share the form as needed to ensure submission.

Complete your Michigan Form 4133 online today to ensure a smooth voluntary disclosure process.

You can get State of Michigan tax forms by visiting the Michigan Department of Treasury’s official website, where you can download and print forms directly. Alternatively, forms are often available at post offices and local government offices. Utilizing Michigan Form 4133 can help clarify which forms you specifically need for your tax situation.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.