Get Home Equity Consumer Loan Application

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the HOME EQUITY CONSUMER LOAN APPLICATION online

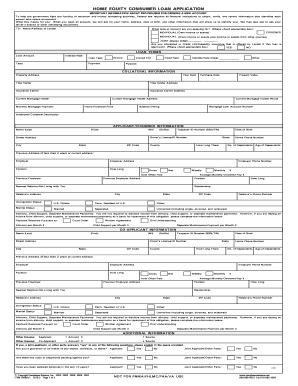

Completing the Home Equity Consumer Loan Application can seem daunting, but with this guide, you will have clear instructions to help you through each section of the form. Follow these steps to ensure your application is filled out accurately and efficiently.

Follow the steps to fill out the form effectively.

- Click 'Get Form' button to acquire the application and have it open for your use.

- Begin with the section titled 'Important information about procedures for opening a new account.' Here, you will be informed about the requirements for identification such as your name, address, and date of birth.

- Move on to the 'Loan type' selection area. Choose the appropriate account type by checking the box next to ‘Individual’ or ‘Joint,’ and indicate if you are applying as a cosigner.

- Indicate whether you are interested in credit life/disability insurance by selecting ‘Yes’ or ‘No’.

- In the 'Loan terms' section, enter the desired loan amount, the interest rate, and specify whether it’s a closed-end loan.

- Provide 'Collateral Information' including the property address, year built, and insurance details. Be sure to include the current mortgage holder's information.

- Fill in the 'Applicant/Cosigner Information' section with personal details. Include your name, taxpayer ID number, date of birth, address, and employment information.

- If applicable, complete the co-applicant information using the same format as the applicant section. Ensure all fields are accurately populated.

- In the 'Additional Information' area, disclose any other income or financial obligations. You must provide details if there are any potential co-signers or debts.

- Review the 'Current Assets' and 'Outstanding Debts' sections, providing information as necessary. Include any additional sheets if more space is required.

- Complete the certification section, ensuring you sign and date the application to confirm the accuracy of the information you provided.

- Finally, save your changes, download a copy for your records, or print the form for submission.

Start completing your HOME EQUITY CONSUMER LOAN APPLICATION online today!

Yes, a Home Equity Line of Credit (HELOC) is classified as consumer debt. It functions similarly to a credit card, allowing homeowners to draw from their available credit as needed. When filling out your HOME EQUITY CONSUMER LOAN APPLICATION or assessing your debts, it's important to consider the potential impact of HELOC debt on your financial situation. This form of financing can be valuable, but it also requires careful management to ensure it fits within your budget.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.